georgia property tax exemptions for veterans

GEORGIA SALES AND USE TAX EXEMPTIONS OCGA. LC becomes LD.

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

If you or your loved one is a veteran you may qualify for a partial or full property tax exemption.

. The exemption applies to certain injured veterans and surviving spouse of those veterans. In addition to the various homestead exemptions that are authorized the law provides a Property Tax Deferral Program whereby qualified homestead property owners 62 and older with a gross. If your 45-day Georgia temporary permit is due to expire please contact our call center at 404-298-4000 for additional information or visit our office with your bill of sale.

Honorably discharged from a branch of the Armed Forces or the. Heres how to find out what your state offers and if you qualify for a senior tax break. Once granted exemptions are automatically renewed each year.

One exception is the Fulton County Low Income exemption which the law requires to be renewed every two years The renewal continues as long as the homeowner continually. Oklahoma law creates an exemption for certain Veterans from property tax. A Rundown on Veterans Property Tax Exemptions by State.

Unless you live in states with low property taxes such as Alabama Hawaii and West Virginia you may need help covering your tax bills. LG becomes LH. Property Tax Exemptions For Disabled Veterans By State Alabama Ad Valorem Tax Exemption Tax Break for Specially Adapted Housing For Veterans.

Valid Georgia insurance electronically submitted into the Georgia Insurance Database or an insurance binder or declarations page less than 30 days old. Not limited to veterans only the ad valorem tax break exempts qualified applicants from ad valorem taxation of a home and an adjacent 160 acres for those who are permanently and totally disabled or who is 65 years of. Local Senior School Tax Exemptions may be stacked with the S5SS Veterans Exemptions however separate application must be filed.

Homestead exemptions are not granted on rental property vacant land or on more than one property in this state or any other state. Our breakdown of veterans property tax. Page 1 Legal Affairs Tax Policy Georgia Department of Revenue 1A Sales to the Federal Government State of Georgia or any county or municipality in Georgia fire districts which have elected governing bodies and are supported by in whole or in.

Some senior citizens qualify for large property tax exemptions. 48-8-3 September 24 2021 EXEMPTION EXEMPTION DOCUMENTATION. The exemption would be for the full fair cash value of the homestead.

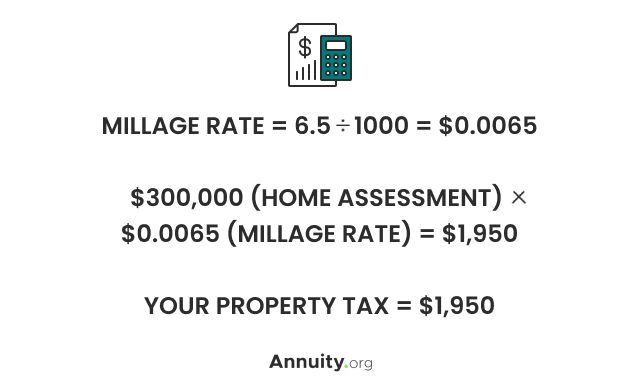

Paying your property taxes is no easy feat.

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

What Is A Homestead Exemption And How Does It Work Lendingtree

The Ultimate Guide To North Carolina Property Taxes

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa States

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Disabled Veterans Property Tax Exemptions By State

Homeowners To See Higher Property Taxes Thanks To The Pandemic Here S What They Can Do Equitax

Homeowners To See Higher Property Taxes Thanks To The Pandemic Here S What They Can Do Equitax

States With Property Tax Exemptions For Veterans R Veterans

Disabled Veterans Property Tax Exemptions By State

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider